Introduction

Problem Statement

Many times businesses face issues of time out in Microsoft D365 F&SC while running Vendor aging reports with large volumes of data. This causes a problem in business continuity and business loss since the customer is not able to fetch the report and is unable to track the Vendor aging and make payment timely.

Feature Details

When you run the vendor aging data storage process to export

the vendor aging report, the results can go to an external system using our

data management framework. This feature provides an efficient way to report on

data when there are large volumes of it.

Configuration and Process

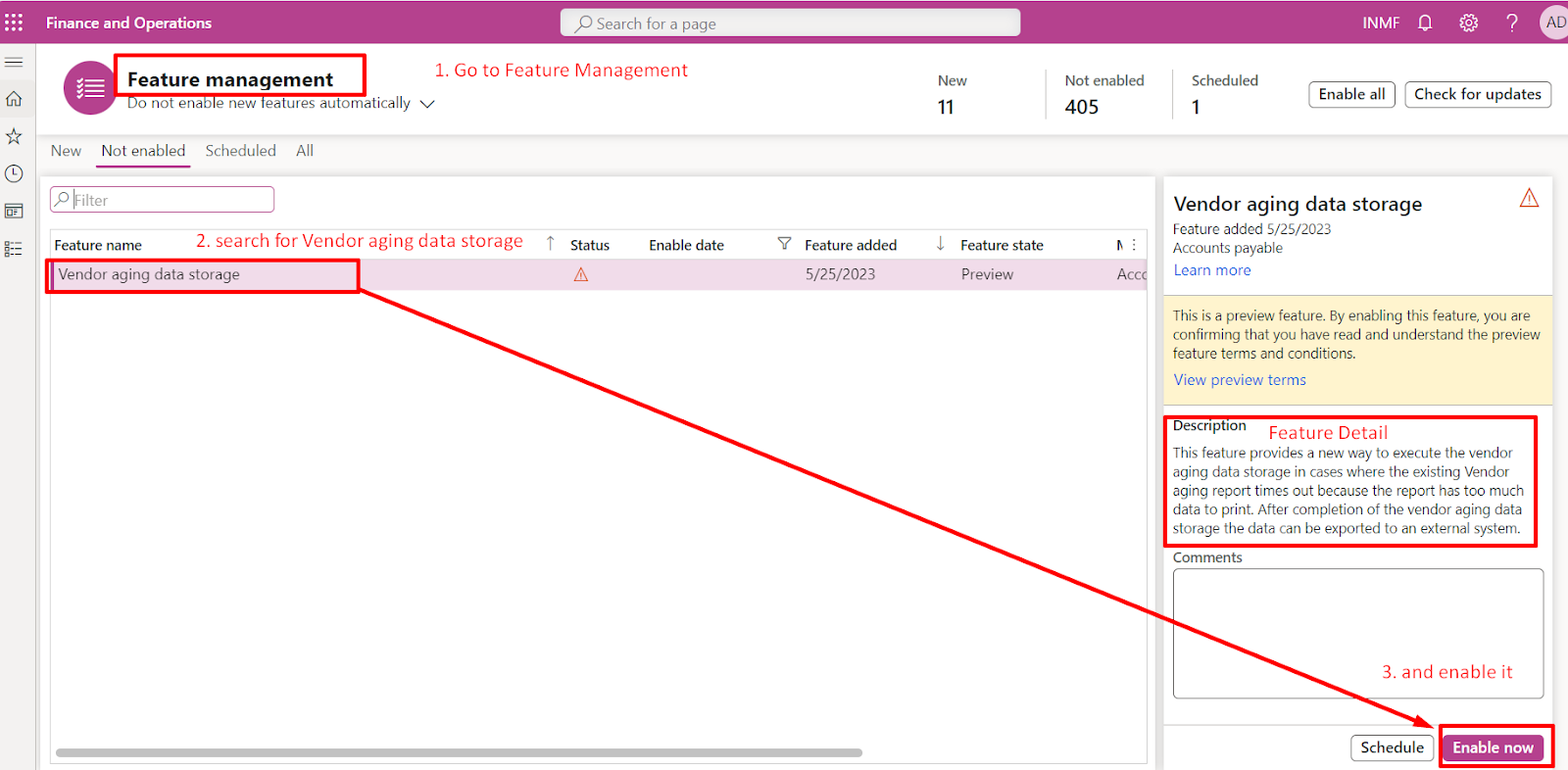

1. Enable the vendor aging data storage feature

In the Feature management workspace, enable the Vendor aging

data storage feature:

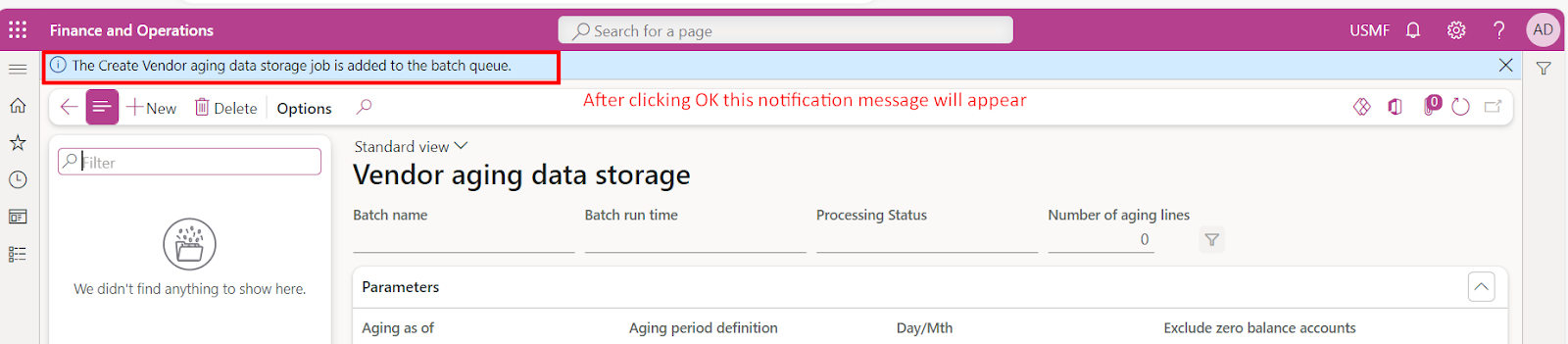

2. Run the vendor aging data storage process

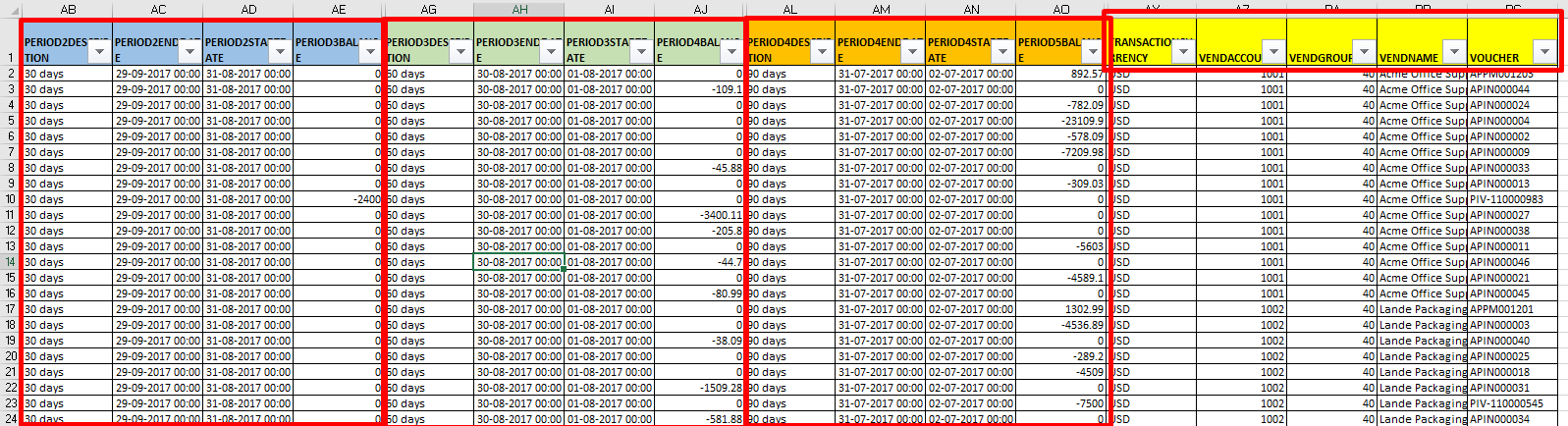

3. Use of Data Management Framework for exporting the Vendor Aging

(D) Batch job will run and Number of aging lines (in our case it was 97 same as at the time of creating Vendor aging data storage in Accounts payable module) will be generated