Introduction

Asset leasing is an advanced capability for managing, tracking, and automating financial transactions for leased assets in Microsoft Dynamics 365 Finance. Asset leasing complies with International accounting standards (IFRS 16) and US GAAP standards (ASC 842).

Lease agreement - The lessor (who owns the asset and provide asset on lease/rent to the lessee) owns the asset and agrees with the lessee (who take asset on lease from lessor) to lease an asset for specific period in exchange for periodic lease payments.

Note: Accounting in D365 Finance will be done on behalf of lessee.

Concept of Asset Leasing

Note: Defined Value (in above image) for Short term lease / low value lease is defined on Lease books as a threshold. Below is the image from D365 Finance & Operation where these value is defined.

Accounting for this - deferred rent treatment is applied (expensed off like a rent) - Income Statement treatment no impact on Balance Sheet

Accounting Entries

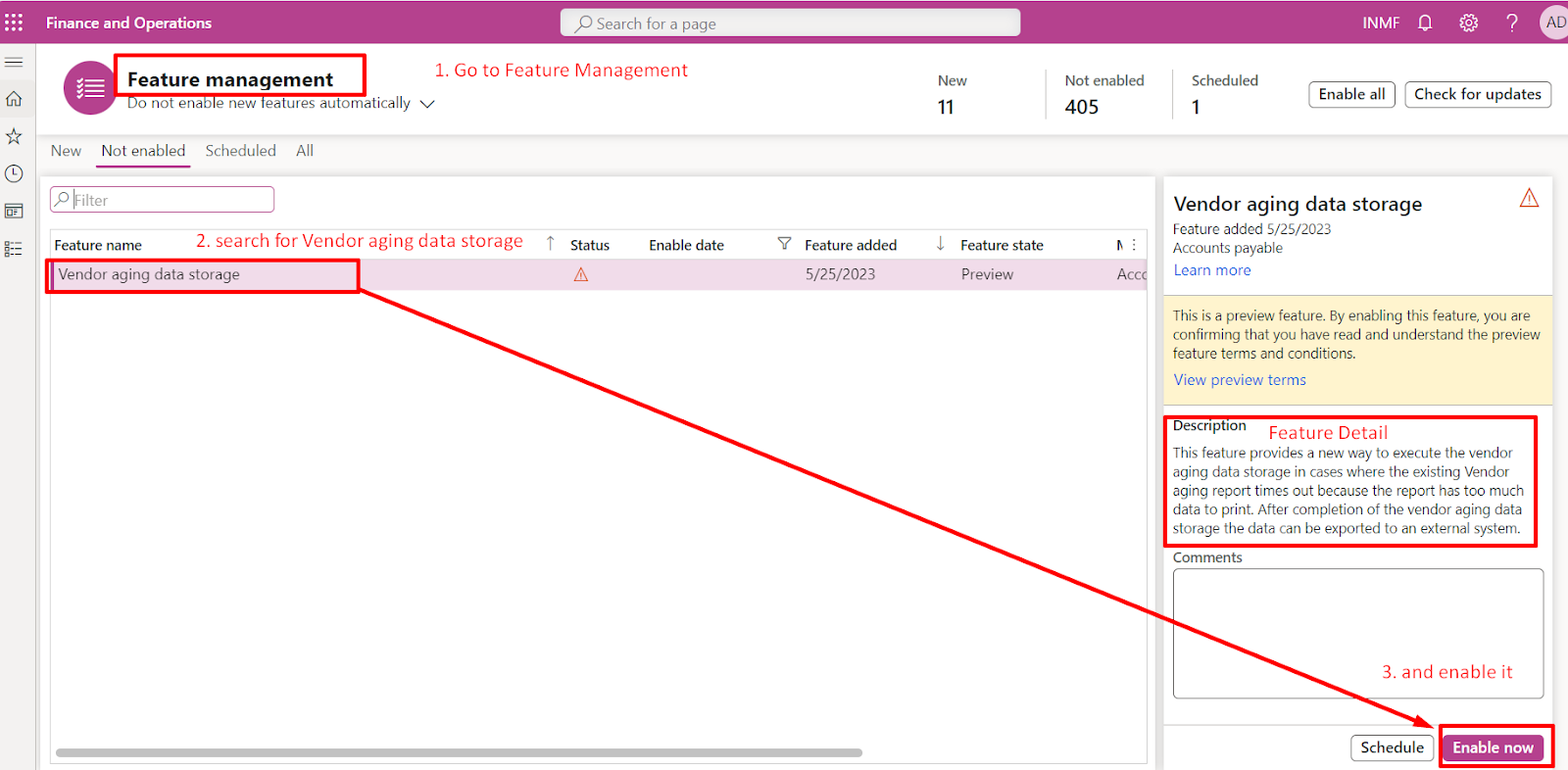

How to enable Asset Leasing Module:

First go to feature management from workspace and then search for Asset Leasing in all and Finally Enable it from Enable Now button in below extream right. After this refresh the browser URL, Asset Leasing Module will be visible in Module Section.

NOTE: We will learn basic configuration of Asset Leasing Module in the Part 2 of the blog.

Thank you

Happy Learning