Business Scenario

- AS per Indian Income Tax Act 1961, Section 194C, If payment to the contractor exceeds Rs. 30000, then TDS would be deducted. This limit is per invoice basis.

- However, if the aggregate of amount paid to the contractor exceeds Rs. 100000, then TDS would be deducted from the whole amount that was non-taxed in the previous transaction.

| Invoice No | Invoice Amount | TDS@2% |

| Inv-01 | 35,000 | 700 |

| Inv-02 | 22,000 | N.A. |

| Inv-03 | 25,000 | N.A. |

| Inv-04 | 21,000 | 1,360 |

| Total | 1,03,000 |

Here, TDS 1360 is calculated on previously non-taxed transactions i.e. (22000+25000+21000) @ 2% = 1360. TDS is calculated because the aggregate of all four invoices is exceeding the threshold limit of 100000.

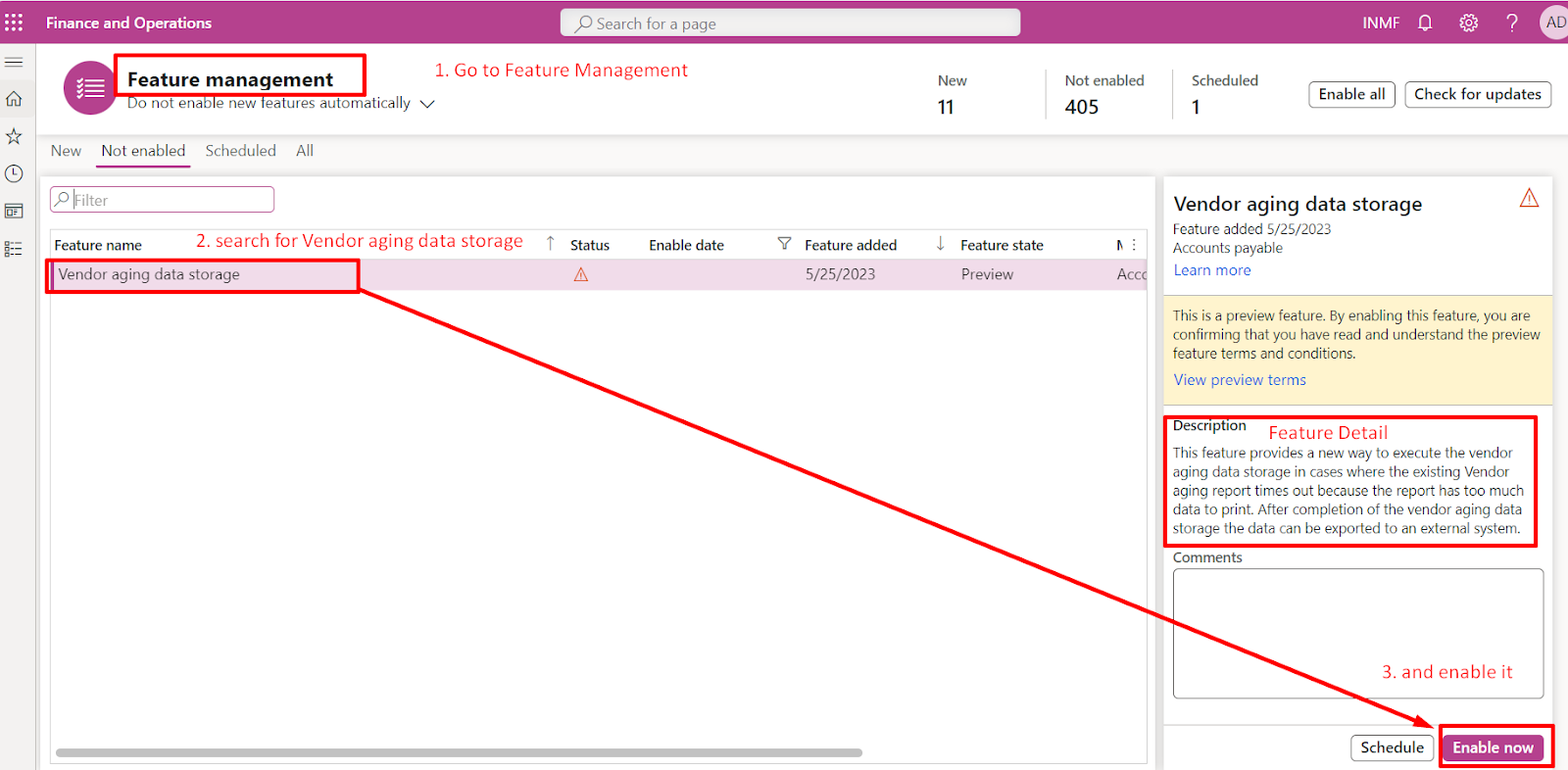

Configuration

1. Click new to create a new withholding tax component group

2. Create withholding tax components

3. Create a threshold definition

Note: mandatorily Make final level yes to the last threshold range like for cumulative 100000 - max and per transaction 30000 - max

4. create withholding tax codes

5. create withholding tax groups

6. Go to withholding tax codes and enable threshold hierarchy

Setup of threshold designer as per scenario:

7 Map TDS group to vendor master and fill in PAN number

Result

| Invoice No | Invoice Amount | TDS@2% | Remarks |

| Inv-1 | 35,000 | 700 | Created Invoice journal and posted for Vendor Vendor1, TDS calculated of INR 700 |

| Inv-2 | 22,000 | N.A. | Created Invoice journal and posted for Vendor Vendor1, No TDS calculated |

| Inv-3 | 25,000 | N.A. | Created Invoice journal and posted for Vendor Vendor1, No TDS calculated |

| Inv-4 | 21,000 | 1,360 | Created Invoice journal for Vendor Vendor1 and tax is correctly calculated on (22000+25000+21000) @2% i.e. 1360 |

| Total | 1,03,000 |

Note: previous 3 transactions should be posted only then in 4th transaction TDS calculation will happen on the non-taxed invoice

Happy Learning!

Thank You

No comments:

Post a Comment

If you have any doubt please do let me know